Published On: Mar 2025

Published On: Mar 2025

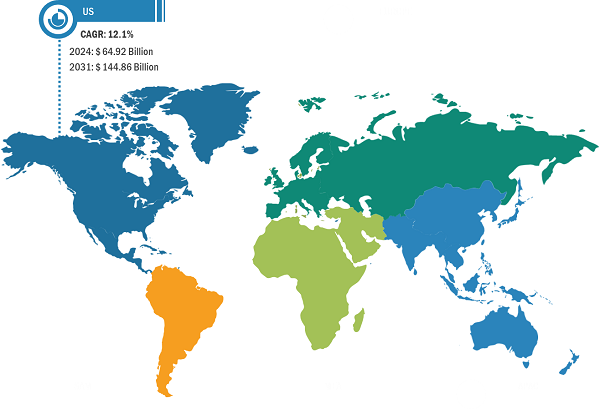

According to our latest study on "US Healthcare Insurance Third-Party Administrator Market – Country Share, Trend, and Growth Opportunity Analysis – by Type and Enterprise Size," the market was valued at US$ 64.92 billion in 2024. The US Healthcare Insurance Third-Party Administrator market size is expected to reach US$ 144.86 billion by 2031. The market is estimated to record a CAGR of 12.1% from 2024 to 2031.

With the rising cost of healthcare, the TPA outsourcing model has become even more essential, especially for companies seeking to manage their financial exposure to unpredictable healthcare expenses. According to the Centers for Medicare & Medicaid Services, the significant increase in insurance coverage in 2022, with the insured share of the US population reaching a historic 92%, contributed to the growth of the healthcare insurance third-party administrator market. As private health insurance enrollment rose by 2.9 million individuals and Medicaid enrollment increased by 6.1 million, the demand for efficient and scalable administrative solutions has surged.

Third-party administrators play a crucial role in managing the complexities of enrollment, claims processing, and compliance for these expanding global populations. As the number of insured individuals continues to grow and the healthcare system becomes more complex, third-party administrators are becoming essential partners for both insurers and employers in streamlining operations and ensuring quality care while managing costs. This rising coverage, coupled with the growing need for administrative efficiency, fuels the expansion of the healthcare insurance third-party administrator market.

Many employers are seeking efficient solutions to manage their benefits programs while maintaining cost-effectiveness and compliance. This is where third-party administrators come into play. Third-party administrators offer essential support to employers by managing the administrative complexities of ESI, including claims processing, eligibility verification, regulatory compliance, and benefits administration. Third-party administrators have become an increasingly attractive solution as more employers, especially those in small to mid-sized businesses, seek to provide health insurance but struggle with administrative burdens and costs.

The expansion of telehealth is expected to prompt third-party administrators to expand their service offerings by integrating digital health services into their portfolios. By partnering with telehealth providers, third-party administrators can enhance the efficiency and accessibility of healthcare solutions, enabling employers and insurance companies to offer more comprehensive healthcare coverage. This integration allows third-party administrators to streamline the care delivery process, making it easier for members to access virtual consultations, follow-up care, and health monitoring from the convenience of their homes. It also enhances customer experience by providing timely, remote healthcare services, particularly for employees in remote areas or those with limited access to traditional healthcare facilities. According to Dialog Health, from 2010 to 2022, the number of Americans using telehealth services saw an impressive increase, expanding from just 300,000 individuals to 27.6 million.

In terms of type, the market is segmented into health insurance, disability insurance, workers' compensation insurance, and others. The health insurance segment held the largest share in the US Healthcare Insurance Third-Party Administrator market in 2024. In the health insurance segment, third-party administrators play a vital role in managing the claims, enrollment, customer service, and compliance aspects of both employer-sponsored and insurer-provided health plans. Many employers, especially those with self-funded plans, rely on third-party administrators to administer their healthcare programs because third-party administrators can handle the complexities of claims processing, network management, and regulatory compliance more efficiently.

Sedgwick; Crawford and Company; CorVel Corp; UnitedHealth Group Inc; Arthur J Gallagher & Co; Meritain Health; EDISON HEALTH SOLUTIONS; ESIS; Cannon Cochran Management Services, Inc.; and Heritage Health Solutions. are among the key players profiled in this US Healthcare Insurance Third-Party Administrator market report. The market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities. A few of the key market developments are listed below:

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com