Published On: Jan 2025

Published On: Jan 2025

According to our new research study on “India Cystoscopy and Ureteroscopy Market Forecast to 2031 –Country Analysis – by Product Type, Procedures, Technology, Usage Type, and End User,” the market is expected to grow from US$ 180.00 million in 2023 to US$ 313.63 million by 2031; it is estimated to register a CAGR of 7.2% from 2023 to 2031.

Cystoscopy and ureteroscopy are medical procedures used to examine and treat conditions of the urinary tract focusing on different areas of the urinary system. Cystoscope and ureteroscope are thin flexible and rigid tube with light and camera attached to it which helps in visualization of the interior of bladder and urethra for treatment and diagnosis of urinary disorders.

Source: Business Market Insights Analysis

Increasing adoption of robotic-assisted surgeries is emerging as a key trend in the India cystoscopy and ureteroscopy market. Robotic surgery, particularly with the use of the da Vinci surgical system, is gaining popularity in urological procedures due to its precision, minimal invasiveness, and ability to reduce recovery times. Robotic systems offer greater control, enhanced visualization, and improved dexterity for surgeons, which are crucial factors when performing delicate procedures such as cystoscopy and ureteroscopy. Furthermore, robotic assistance in urological surgeries allows for better outcomes with fewer complications, shorter hospital stays, and faster recovery. These benefits are particularly important in cost-sensitive economies such as India. Robotic surgeries also aid relief for healthcare providers by reducing blood loss, shortening operating times, and mitigating postoperative complications.

As of 2021, there were nearly 76 fully functional surgical robots and over 500 surgeons trained to carry out robotic surgeries across India. The Asian Institute of Nephrology and Urology (AINU) in India is a world-class hospital specializing in urology. AINU's expertise in robotic surgery is renowned, particularly in the field of prostate-related conditions, making it home to the best surgeons trained in robotically aided procedures. The trend toward robotic-assisted surgeries in India is being driven by the increasing number of hospitals and surgical centers adopting advanced technologies. Major hospitals in metropolitan cities such as Delhi, Mumbai, and Bangalore have already begun deploying robotic systems into their urology departments. As technology becomes more affordable and accessible, smaller hospitals and clinics are also beginning to explore robotic systems.

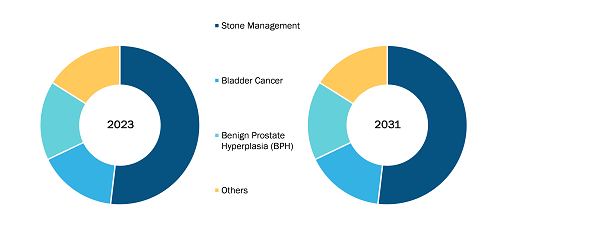

Based on procedure, the India cystoscopy and ureteroscopy market is segmented into benign prostrate hyperplasia (BPH), bladder cancer, stone management, and others. The stone management segment accounted for the largest India cystoscopy and ureteroscopy market share in 2023. Moreover, the same segment is anticipated to register the highest CAGR in the market during the forecast period. Cystoscopy plays a crucial role in detecting and managing urinary stones, especially those located in the bladder or lower urinary tract. By utilizing a cystoscope—a thin, flexible tube—physicians can directly visualize the stones, and assess their size and location, in turn making decisions about the selection of appropriate treatments such as stone extraction or laser lithotripsy. Recent technological advancements in cystoscopy have brought significant improvements in the detection and management of urinary stones. High-definition (HD) and digital cystoscopes provide clearer and more detailed images, making it easier to identify small or difficult-to-detect stones. In addition, innovations such as laser cystoscopy enable the use of laser energy during procedures to fragment and remove stones, thereby minimizing the need for more invasive surgeries. The integration of NBI and fluorescence imaging also enhances the visualization of bladder stones, offering better contrast compared to traditional white-light cystoscopy.

Based on product type, the India cystoscopy and ureteroscopy market is segmented into cystoscope, ureteroscope, and urology camera. The cystoscope segment accounted for the largest India cystoscopy and ureteroscopy market share in 2023.

Based on technology, the India cystoscopy and ureteroscopy market is segmented into fiber optic, video, and others. The video segment accounted for the largest share of the total India cystoscopy and ureteroscopy market size in 2023.

Based on usage type, the India cystoscopy and ureteroscopy market is bifurcated into reusable and single use. The reusable segment accounted for a larger share of the market in 2023. However, the single use segment is anticipated to register a higher CAGR in the market during the forecast period.

Based on end user, the India cystoscopy and ureteroscopy market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment accounted for the largest share of the market in 2023, and same segment is anticipated to register the highest CAGR in the market during the forecast period.

Olympus Corp, Karl Storz SE & Co KG, Richard Wolf GmbH, Ambu A/S, PENTAX Medical, Advin Health Care Pvt Ltd, Coloplast Corp, Cook Medical Holdings LLC, Electronics Services Centre (ESC Medicams), Stryker Corp, Rudra Surgicals, Laborie, Teleflex Inc, NIDHI MEDITECH SYSTEMS, Pioneer Healthcare Technologies, Boston Scientific Corp, Ottomed Endoscopy, Becton Dickinson and Co, SCHÖLLY FIBEROPTIC GMBH, and MicroPort Scientific Corp are among the key players operating in the US non-emergency medical transportation market.

Contact Us

Phone: +16467917070

Email Id: sales@businessmarketinsights.com