Report : East Africa Scaffolding Market Size and Forecast (2021 - 2034), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Frame Scaffolding, Tube and Clamp Scaffolding, Ringlock Scaffolding, Cuplock Scaffolding, and Others), Offering [Scaffolding Products (Sale) and Rental Solutions], Application (Residential Building, Commercial Building, Industrial, Oil and Gas, and Events), and Country

Increasing Power Infrastructure Development Initiatives Boost East Africa Scaffolding Market Growth

According to our latest market study on "East Africa Scaffolding Market to 2034 – Regional Analysis – by Offering, Type, and Application," the East Africa scaffolding market was valued at US$ 89.03 million in 2023 and is expected to reach US$ 122.57 million by 2034; it is anticipated to register a CAGR of 2.9% from 2023 to 2034. The East Africa scaffolding market report includes growth prospects in light of current trends and driving factors influencing the market growth.

Governments of various countries in East Africa and key players operating in all industries are significantly focusing on reducing their carbon emissions and increasingly adopting green energy. With such an increase in the demand for green energy, the need for green infrastructure is growing notably. Governments of Tanzania, Uganda, Rwanda, and Kenya are announcing funding and initiatives to develop green infrastructure projects. For instance, as per the Climate Investment Funds, the government of Kenya set ambitious clean energy goals, such as achieving 100% clean energy on the electricity grid by 2030. Kenya’s Menengai geothermal project, which consists of three modular power plants with an individual capacity of 35%, is expected to provide electricity to half a million households in the country by 2025.

The first plant, built by Nairobi-based Sosian Energy, is already in operation. The second power plant, currently under construction by Globeleq, one of Africa's leading independent power producers, is expected to be operational by the end of 2025. In addition, a few of the ongoing energy infrastructure projects are the East African Crude Oil Pipeline, Lake Albert Refinery (Uganda), and Julius Nyerere hydropower project (Tanzania). Such government initiatives to build green energy infrastructure are estimated to increase the demand for construction and safety materials. Thus, the East Africa scaffolding market size is likely to surge by 2030 owing to the growing number of power infrastructure development initiatives.

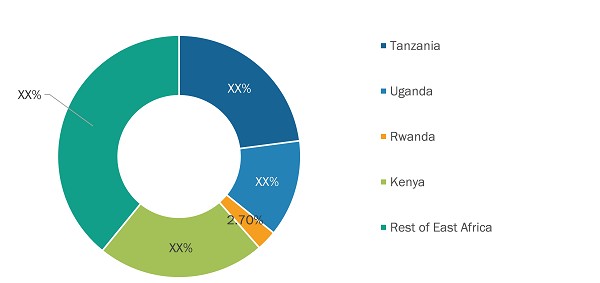

East Africa Scaffolding Market Share — by Country, 2023

Source: Business Market Insights Analysis

The scope of the East Africa scaffolding market report focuses on Tanzania, Uganda, Rwanda, Kenya, and the Rest of East Africa. In terms of revenue, Tanzania accounted for the largest East Africa scaffolding market share in 2023 and is anticipated to fuel the market growth from 2023 to 2034. The construction sector in Uganda has grown significantly in recent years. The industry's growth is fueled by several factors, including the country’s growing population, urbanization, and government infrastructure projects. One of the most ambitious government projects was the development of new cities. On July 1, 2023, the government of Uganda announced the operationalization of five additional cities following the elevation of seven municipalities to city status in 2020. Mbarara, Jinja, Gulu, and other towns are receiving significant infrastructure improvements, which leads to increased construction activity in the residential, commercial, and public sectors. This urbanization strategy is expected to decentralize services and promote balanced growth across the country.

According to the Uganda National Planning Authority, Uganda has a housing shortage of eight million units. With an estimated 300,000 residential units needed per year, commercial and residential construction is increasingly growing in the country. The government allocated 8.5% of its 2023/2024 budget to transport and infrastructure. A crude oil export pipeline is currently being built between Kabaale in Uganda and Chongoleani in Tanzania. The 1,445 km project is expected to be the longest crude oil export pipeline in the world. In addition, the rise in government initiatives toward the development of infrastructure across various industries is expected to raise the demand for scaffolding in the construction sector in the coming years. This factor is likely to fuel the East Africa scaffolding market growth in the near future.

As per the National Institute of Statistics of Rwanda (NISR), the population of Rwanda is expected to reach 22–25 million by 2050. With urbanization in Rwanda, there is an increased need for improved connectivity to basic services and quality of life. Further, real estate is a key sector and a potential driver of economic growth. The Rwandan government is actively promoting real estate development as part of our Vision 2050 plan to have 70% of the population living in urban regions by 2050. The sector contributes ~16% of Rwanda’s GDP in 2023. The sector experienced significant growth owing to urbanization, population growth, and the rising demand for housing and commercial space. By 2050, Rwanda aims to have a formal housing sector that is available and accessible to all population groups.

Rwanda's economy recorded a growth rate of 9.8% in the second quarter of 2024, following an increase of 9.7% in the first quarter. According to the Institute of Statistics of Rwanda, GDP at current market price was estimated at US$ 3.3 billion in the second quarter of 2024, a significant increase from the same quarter of 2023. The industrial sector recorded a notable growth of 15%, mainly due to an increase in construction activities (18%) and manufacturing (17%) as compared to the same quarter in 2023. Thus, owing to economic growth, construction activities across the country are anticipated to increase, which is likely to fuel the demand for scaffolding from 2023 to 2034.

The key stakeholders in the East Africa scaffolding market are raw material suppliers, manufacturers, scaffold suppliers/distributors, and end users. In recent years, the demand for scaffolding has been growing significantly owing to the rising infrastructure development initiatives by the government and private/public companies operating in the market. Steel, aluminum, and other raw materials are supplied for the designing and manufacturing of scaffolding products. Scaffolding manufacturers play a crucial role in the market ecosystem as they are in constant synchronization with end user demands as well as regulatory/industry bodies to develop required products integrated with the latest technologies. Scaffolding solutions can also be customized for industries such as power, construction, oil and gas, and events.

A few of the key scaffolding manufacturers are HUGO Scaffolds Limited, Wapo Scaffolding (T) Limited, Southey Contracting, and Liberty Events and Contracts Scaffolding Ltd. These companies design and produce scaffold systems using a variety of materials, technologies, and innovations. They focus on creating scaffold components that are safe, durable, and compliant with industry standards. In addition to these major market players, several other peripheral stakeholders play a crucial role in enabling technological advancements and the adoption of efficient and reliable scaffolding solutions across several industries.

Suppliers and distributors build a connection between scaffold manufacturers and end users. They play a major role in distributing scaffold components to construction companies, contractors, rental companies, and other customers. A few end users of the East Africa scaffolding market are residential buildings, commercial buildings, industrial, oil and gas, and events. Construction firms are among the primary end users of scaffolding systems. They deploy scaffold systems to access elevated areas, ensuring worker’s safety and facilitating construction, maintenance, and renovation projects. The collaboration and partnerships among these stakeholders form a dynamic ecosystem that supports the growing East Africa scaffolding market size. Each stakeholder contributes to the effective utilization of scaffold systems, ensuring that construction projects are completed safely, efficiently, and according to industry standards.

The East Africa scaffolding market analysis is carried out by identifying and evaluating key players in the market. HUGO Scaffolds Limited, Wapo Scaffolding (T) Limited, Southey Contracting, Liberty Events and Contracts Scaffolding Ltd., Form-Scaff (Parent - WACO International), SA Scaffold Group, Kasthew Construction Uganda, Neetoo Industries & Co. Ltd., Afix Scaff (Mauritius) Ltd, and ACE SCAFFOLDINGS Co Limited are among the key players profiled in the East Africa scaffolding market report.

Contact Us

Contact Person: Sameer Joshi

Phone: +1-646-491-9876

Email Id: sales@businessmarketinsights.com