Report : Americas Frozen Bakery Products Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Bread and Rolls, Cakes and Pastries, Biscuits and Cookies, and Others), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others), and Country

Rising Demand for Frozen and Convenience Food in Americas

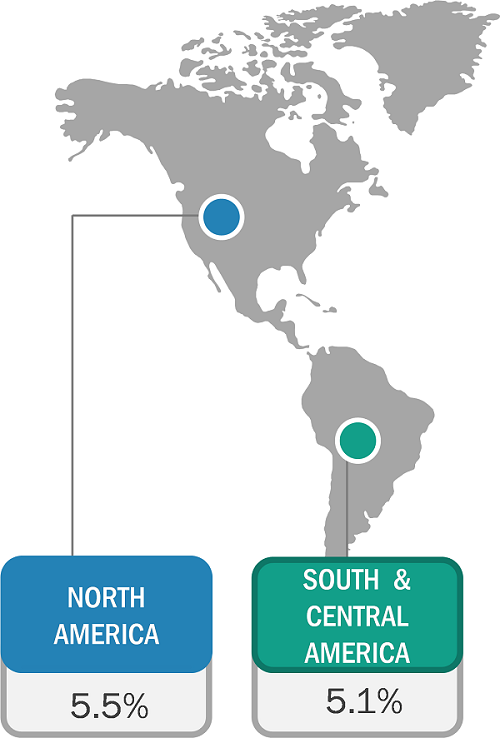

According to our new research study on “Americas Frozen Bakery Products Market Forecast to 2031 – by Product Type, Category, and Distribution Channel,” the market was valued at US$ 4.21 billion in 2023 and is projected to reach US$ 6.40 billion by 2031; it is expected to register a CAGR of 5.4% during 2023–2031. The report highlights key factors propelling the market Americas frozen bakery products market growth and prominent players along with their developments in the market.

Hectic work schedules are changing the lifestyle and eating habits of consumers, thereby increasing their dependency on convenience foods and frozen food products. Convenience foods, such as frozen bakery products, allow consumers to save time and effort associated with ingredient shopping and baking preparations. The food industry is witnessing a surge in the consumption of high-quality convenience food. According to the “2023 Power of Frozen in Retail” by The Food Industry Association and the American Frozen Food Institute, frozen food sales in the US increased by 7.9%, reaching US$ 74.2 billion over the year ended July 2023. The Millennial and Gen X populations are the major consumers of these products, shopping mostly in supercenters and through online channels. As per the government of Canada, the retail sales of frozen bakery products in Canada were reported to be US$ 280.8 million in 2022.

Prominent market players offer a variety of frozen bakery products, including bread and rolls, biscuits and cookies, donuts, and muffins. These products have extended product shelf-life due to the blast-freezing process. Frozen bakery products also save the effort and time spent on food preparation and provide the convenience of storage. According to the “2023 Food and Health Survey” conducted by the International Food Information Council in 2023, out of 1,022 Americans (aged between 18 and 80 years), 61% of participants chose convenience as a major factor impacting food buying decisions in 2023, which was 56% in 2022. Preprocessed food allows consumers to save time and effort associated with food preparation and reduces baking time. Thus, the rising demand for frozen and convenience food drives the Americas frozen bakery products market.

Americas Frozen Bakery Products Market: Trends

The market report includes growth prospects owing to the current Americas frozen bakery products market trends and their foreseeable impact during the forecast period. Consumers are increasingly seeking healthy, nutritious food products, which has surged the demand for healthy alternatives such as gluten-free, high-fiber, high-protein, or low-calorie frozen food over conventional bakery goods. Gluten-free frozen products are convenient and accessible and contain healthy ingredients. The incidence of celiac disease (gluten sensitivity) is rising among the population in the Americas. According to the Celiac Disease Foundation, as of 2022, 3 million Americans were affected by celiac disease, and ~60–70% of Americans remain undiagnosed in the country. It is recommended to consume a 100% gluten-free diet for people suffering from celiac disease. Overall, the rising number of people diagnosed with celiac disease and growing awareness for gluten-free diets are a few factors positively impacting innovations pertaining to gluten-free bakery products. As a result, manufacturers are focusing on developing innovative products to cater to the consumer demand for healthy and gluten-free bakery food products. In 2023, Doughlicious launched its gluten-free and non-GMO frozen products in America. The gluten-free portfolio includes puff pastry squares, puff pastry sheets, pita, and pizza dough. Therefore, the rising consumer preference for gluten-free products is expected to bring new trends in the Americas frozen bakery products market in the coming years.

Americas Frozen Bakery Products Market Growth

In North America, consumer preferences are shifting toward healthy and nutritious food options, which has surged the demand for vegan, gluten-free, high-fiber, high-protein, or low-calorie food, further influencing the frozen bakery products market. This factor contributes to the Americas frozen bakery products market share. According to the "2023 Power of Frozen in Retail" by The Food Industry Association and the American Frozen Food Institute, frozen food sales in the US increased by 7.9%, reaching US$ 74.2 billion between July 2022 and July 2023. The Americas frozen bakery products market report also reveals that the number of online grocery shoppers' share who purchase frozen food through e-commerce channels is rising significantly. In 2020, 86% of online shoppers in the US who bought groceries online purchased frozen products through online retail. The top six reasons for purchasing frozen food are the long shelf-life of frozen foods (60%), consumer desire to stock up in case of food shortages (58%), the ease of preparation (46%), saving time on preparation and cleanup (36%), and consumers' belief that frozen foods are safer than fresh items (33%). As per the government of Canada, the majority of Canada-based bakery products were distributed through store-based retailing, with supermarkets accounting for a significant share in the Americas frozen bakery products market share in the sales of bakery products. Thus, the rising demand for frozen food drives the frozen bakery products market in the region.

The Americas frozen bakery products market analysis has been performed by considering the following segments: product type, category, and distribution channel. By product type, the market is segmented into bread and rolls, cakes and pastries, biscuits and cookies, and others. The breads and rolls segment accounted for the highest market share in 2023. By category, the market is segmented into gluten-free and conventional. The conventional segment accounted for a higher market share in 2023. In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest share in the Americas frozen bakery products market in 2023. In the Americas frozen bakery products market, supermarkets and hypermarkets play a key role in reaching a wide consumer base. Supermarkets, known for their extensive product offerings and accessibilities, serve as primary retail outlets for frozen bakery products. The diverse product range of hypermarkets provides a more expansive platform for the distribution of frozen bakery products. The visibility of these products in hypermarket settings enhances consumer awareness and accessibility. Further, the ability of hypermarkets to negotiate bulk purchases with suppliers is expected to impact their pricing and promotions, making frozen bakery products more appealing to a broader audience. These distribution channels offer a convenient and familiar environment for consumers to explore and purchase frozen bakery products, aligning with the broader trend of making such products easily accessible. Owing to their large customer base, manufacturers in the frozen bakery product industry typically prefer to sell their goods through supermarkets and hypermarkets. Major supermarket chains such as Walmart and Tesco have partnered with frozen bakery products manufacturing companies to maintain an uninterrupted supply of popular brands contributing to the growing Americas frozen bakery products market size.

Grupo Bimbo SAB de CV, Rhodes International Inc, General Mills Inc, Pepperidge Farm Inc, Bridgford Foods Corp, Conagra Brands Inc, Cole’s Quality Foods Inc., Sara Lee Frozen Bakery LLC, T. Marzetti Company, and The Edwards Baking Company are among the leading companies profiled in the Americas frozen bakery products market report.

Contact Us

Contact Person: Sameer Joshi

Phone: +1-646-491-9876

Email Id: sales@businessmarketinsights.com